In a recent interview with CNBC ‘Money Movers’ host Mark Quintanilla, WisdomTree CEO Jonathan Steinberg announced that crypto is going and will continue to be mainstream in the coming years. This sentiment is further strengthened by the recent speech by former US President Donald Trump in a recent Bitcoin conference that saw huge potential for investors.

The Key To Open The Mainstream Door

According to Steinberg, the former President’s ambitiousness on the crypto side makes it all the more enchanting to retail investors. Trump’s promises of regulatory clarity for Bitcoin and crypto as an asset class is a big deal for the crypto market which has since been bombarded by the Securities and Exchange Commission (SEC) with regulatory action.

“I think that would have a very positive effect. Not just on crypto, the asset class, which is really only half the story, but also blockchain enabled finance which WisdomTree is a very early leader in,” said Steinberg.

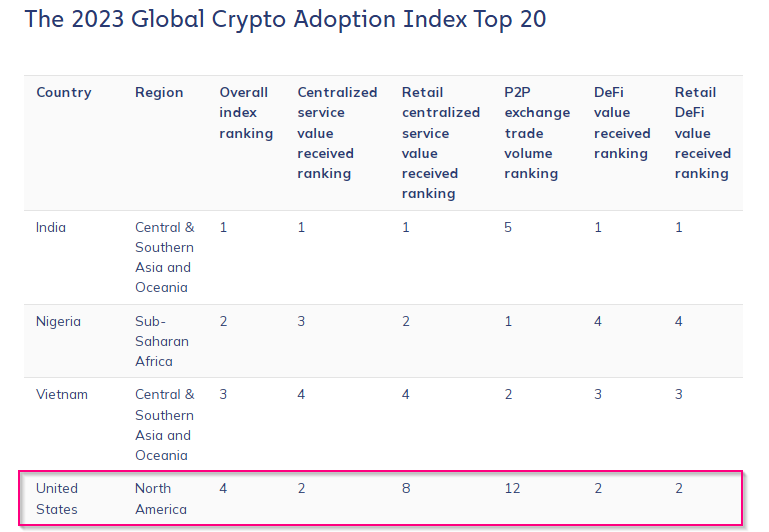

Clear regulation is key to mainstream crypto adoption in the United States. In fact, the US is quite behind in adopting crypto within its regulatory framework. According to Chainalysis, the US only ranks fourth in the global crypto adoption index, tailing Vietnam, Nigeria, and India.

Another factor mentioned is how Bitcoin performs, beating private equity in the long term.

“What’s so interesting about Bitcoin, with no employees, and no institutional buying, its raised more than a trillion dollars. And now crypto as an asset class is well over 2 trillion dollars. I think it will mainstream and continue to mainstream in the years ahead,” Steinberg said.

Although Bitcoin and crypto in general are gaining traction within the retail investor space, there are still hurdles to overcome before becoming fully mainstream.

Crypto Jargon Opacity Continues To Blur Mainstream Eyes

Quintanilla mentioned the complex jargon unique to the space like “halving”, “decentralized finance”, and “real-world asset tokenization” which “are still kind of scary to a lot of people that may be considering jumping in.”

However, Steinberg slides in the argument that regulators are skeptical of the asset class, thus blocking further mainstream adoption which makes the retail investors– who are passionate about the asset class– confused on what really crypto is about.

“And so it has been embraced, but really it hasn’t mainstreamed yet. You are seeing it start to mainstream with the crypto ETPs that have been launching in Europe and in the US, and that development will continue,” said Steinberg.

Steinberg also cited WisdomTree’s experience with launching its first exchange-traded fund (ETF) 20 years ago. He said that confusion in early adoption is normal, but term normalization will occur once retail investors catch the core tenets of the asset class.

Featured image from New Digital Age, chart from TradingView

from Bitcoinist.com https://ift.tt/6MALBhs

https://ift.tt/PZJ3LHE July 31, 2024 at 03:00AM